I did a talk recently and thought I could share four pertinent thoughts based on the kind of questions raised to me.

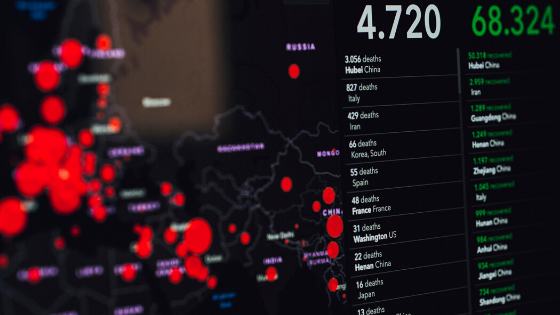

In my living memory I have not seen an environment like this. I am 55 years old and the previous crisis I lived through was the one in 1974 when I was a child. I started my career in 1991 and during the 1997 Asian crisis I was in the thick of it. Then came the Enron and Worldcom contagion, 9/11, SARS (when I was in Singapore), the dot com bubble, global recession in 2008, and the H1N. But none of these crises have impacted the world the way Covid-19 has.

And why is that?

1. Either they impacted part of the global economy or was related to a financial crisis. This time we have a global impact affecting the real economy (commerce, industry, services and manufacturing etc), so far over 100 countries (and the biggest) have all been impacted in the real economy with the financial sector suffering (stocks markets tumbling) and also in stress. Note that this is not a financial crisis. On top of that there is a sense of fear and uncertainty which impacts confidence of businesses to maintain continuity.

2. In in the previous dislocations – the 2008 financial crisis for example – central banks acted in a highly coordinated manner. This was slow in forthcoming but we got there in the end. However more striking was that in previous crisis, interest rates globally in the major economies was in the broad range of around 5-7%. Thus drastic cuts in 2008 down to 2% range, had a significant impact on economies and people’s pockets. Today this tool is much weaker in impact with rates averaging 2% starting point. So not much to reduce. Could we see negative rates, impact on depositors not to forget pensions. Dividends cuts by institutions whilst the correction will impact those who depend.

3. Globally, many economies are still recovering from the tight belting and fiscal injections in 2008. The fiscal policy now, spending surpasses anything spent by Govts in my life time. Whilst absolutely needed and the correct decision, will lead to some form of belt tightening for years to come.

4. Since the Second World War, the world has looked rightly or wrongly to one of the world’s richest nation, USA for leadership and that has always been impending both politically and actions by central bank etc. To some degree that is lacking. Hence many actions by countries whilst correct have come in hap hazard manner rather than highly coordinated and in a manner to restore confidence. Yet again these are not normal times.

My views on the impact that we see today:

The poor and less developed countries globally will continue to struggle further. This is not new, but it is depressing, as progress on poverty globally was moving in a positive direction. What we see right now it is a major set-back. The middle class will see an incredible wealth impact as markets could take 5+ years to recover – on pensions, (retirement), jobs, pay growth may well stagnate, insecurity in jobs may well increase and the youth may well struggle. This is the time for banks and corporates to step up.

But, that’s enough negativity. What do I expect to change and hope for?

1. We see the return of streets connecting, communities coming together. A planet we all care about

2. A fairer society one that is more caring and looks to help less fortunate, it’s we and not me hereon

3. The end to a culture of greed and disproportionate pay gaps from bottom to top in multiples. People focus more on the necessities and less on the luxury, and save what little they can for the long term

3. An employer which values not only profit but employees, builds a real connection with communities

and reflects about making a difference to the environment. Executives which show leadership not just in words alone but actions as role models to their employees and society, think long term.

4. A society which is more tolerant and the re-emergence of leadership, the statesman in

politics which has become decisive in some cases, point scoring rather that finding common ground

for the better of the nation state.

We have seen some wonderful things happening globally, communities rallying round to support the elderly, homeless and less privileged – so the DNA is there.

But, what’s the lingering fear?

Returning to business as usual, a global depression. I looked at 1929 in the US, the impact was profound on people’s life’s, death, fear and poverty.

About the author: Sundeep Bhandari

Sundeep, is currently INED with PNBIL UK, Chairing the Board Risk Committee. He is a Trustee with the charity, 15 billion-EBP, which delivers work and career related programmes with schools and employers for young people. Furthermore, he is a Governor at Stanmore College and Chairs the Audit and Assurance Committee. Sundeep is also a mentor with Virgin Start-up supporting young entrepreneurs as well as works provides pro bono to support small businesses. Born in Northern Ireland he graduated from the University of Ulster and holds an MBA from City University, London. He previously enjoyed both a domestic and international career in Financial Services, working in London, Singapore, Mumbai, and Hong Kong and was a guest lecturer on the HKUST MBA program on Ethics and Management Dilemmas.

Sundeep is also a member of the Maanch Advisory Council:

“Maanch is an exciting platform that will make its presence felt in the social impact space, by delivering the ability to measure outcomes of donations. Darshita’s drive and passion of turning a dream into reality is happening.”