Adopting the 3 key principles of the circular economy: (i) design out waste and pollution, (ii) keep products and materials in use, (iii) regenerate natural systems, circular financing is a fast emerging research space covering the best practices/strategies of transitions of the financial market players.

| WHO | LEVEL | WHAT |

| Companies | Micro | Switch from linear to circular business model → Retained ownership of the product for rental or functional sales in multiple use cycles over a long period of time instead of selling directly after manufacture or possibly after a shorter period in stock → Balance sheets become larger and cash flows changes → Internal and external stakeholders have to be educated and adapt to new needs, risks evaluation criteria and routines |

| Business Ecosystem | Meso | Increases the collaboration between manufacturing companies and financiers → New frameworks and processes for data shares and information → Greater risks and hence need for transparency → Robust reporting systems and effective disclosures → New opportunities for engaging customers |

| Economy as a whole | Macro | Real economy becomes more circular with closed and slow material loops → Long product lifelines → Financial flows become more long term and value generating / creating |

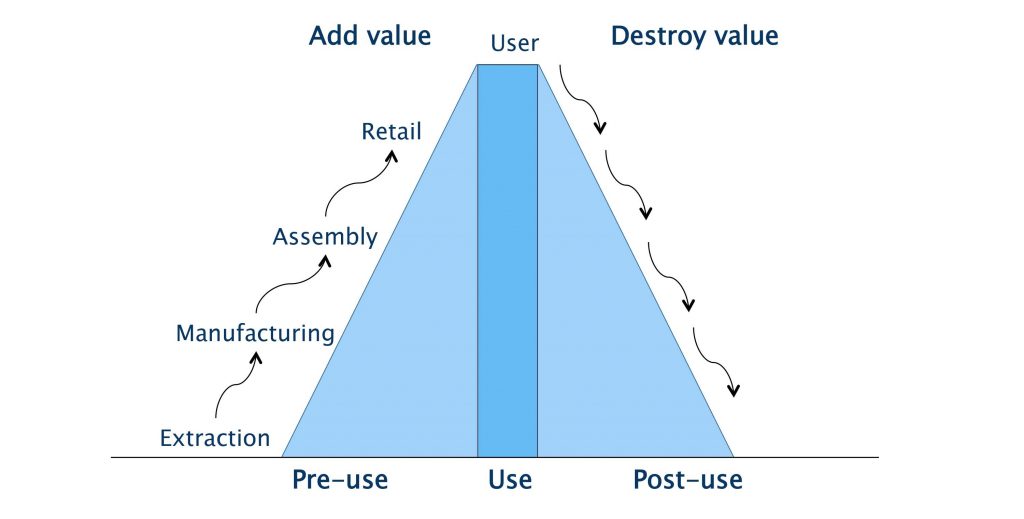

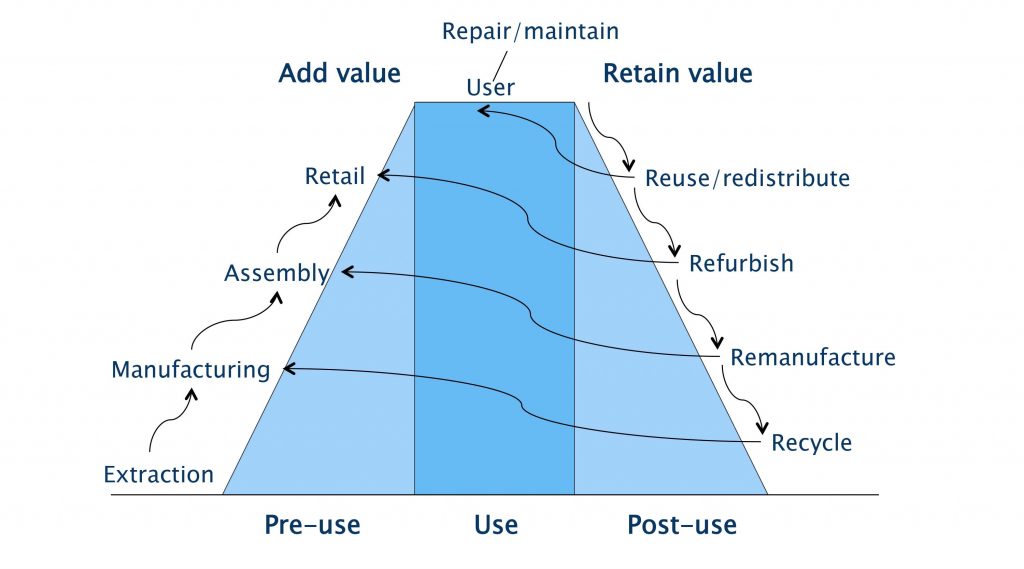

As we can see below, a circular model would mean a prolonged period of engagement with the user/customer/client as the shelf life of the product increases with reuse, recycle and repurpose opportunities at every stage of the post use and pre-use process. The lifecycle E2E as a whole has gained nuance and complexity, which enables impact creation and tagging 121 with the SDGs or an ESG framework at more granular levels, both to capture positive and negative externalities.

Subscribe to our newsletter for latest industry updates. Click here.