As the financial landscape evolves, the demands of Gen Z investors are significantly reshaping how asset managers approach risk, return, and real-world impact. These digital natives are not only reshaping investment trends but are also redefining the very essence of stewardship. This blog explores how the values and expectations of Gen Z are transforming the principles of effective stewardship in the financial sector.

Understanding Gen Z’s Investment Perspective:

Generation Z, those born between 1996 and 2012, are true digital natives who grew up during the rise of social media and rapid technological advancements. This generation is entering the financial market with distinct characteristics that set them apart from previous ones.

- Values: They are not only tech-savvy but also highly value transparency, sustainability, and ethical governance.

- Quantum: Furthermore, they are expected to inherit approximately $70 trillion in the great wealth transfer over the next two decades.

- Investment Age: They are more likely to start investing early, with data showing that they are 45% more likely to invest by age 21 compared to Millennials.

- Risk Appetite: Moreover, their approach encompasses both traditional and virtual assets, showcasing a comfortable fluency in diverse financial environments.

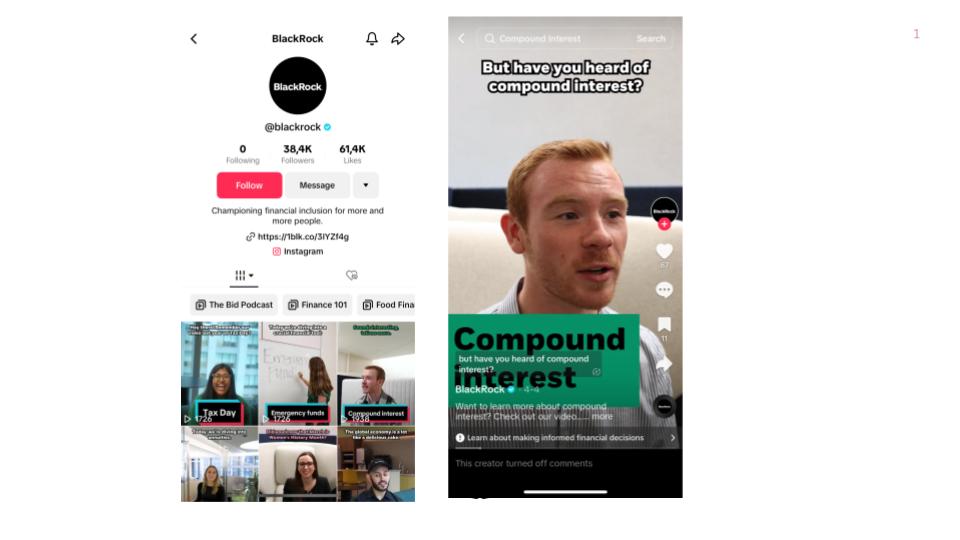

Here is a short 1 minute fun video to give you an insight into Gen Z investment sentiment: https://vm.tiktok.com/ZGeHUaHt4

Understanding Gen Z’s Investment Profile:

Gen Z investors stand at the forefront of a major shift. By 2025, global ESG assets are projected to surpass $53 trillion, signalling a drastic shift towards sustainable investing. These young investors prioritise environmental, social, and governance (ESG) factors not merely as a side consideration but as integral to their investment decisions. They look for authenticity and impact, preferring investments that offer transparency and contribute positively to the world.

Engaging Gen Z Through Modern Channels:

Major firms like BlackRock are adapting to Gen Z’s preferences through social media engagement. By launching a TikTok account, BlackRock actively combats misinformation and connects with young investors. This strategic pivot highlights how asset managers can build trust and enhance understanding of investment processes among Gen Z.

Stewardship That Aligns with Gen Z Values:

Research indicates that a staggering 66% of high-net-worth young investors want increased personalisation in their wealth management relationships. The stewardship model that appeals to Gen Z focuses on predictive, not merely reactive strategies. They expect consistent practices that prioritise environmental and social issues alongside governance. This generation demands more than just data; they seek solutions that reflect their values and offer tangible impacts.

Challenges and Opportunities in Meeting Gen Z Demands:

- Adapting Investment Products:

Gen Z investors show a strong preference for blending traditional investments with modern asset classes. This includes an increased interest in cryptocurrencies, digital assets, NFTs, and impact investments in private companies. To meet these diverse needs, asset management products must diversify beyond traditional stocks and bonds. Incorporating these newer asset classes can attract Gen Zs, aligning investment opportunities with their technological fluency and investment expectations.

- Overcoming Challenges with Data and Technology:

The traditional methods of engagement and reporting must evolve. Asset managers need to leverage technology to minimise data silos and offer more intuitive digital experiences. This includes adopting platforms integrating vast arrays of ESG data points and providing accurate, up-to-date information for reporting and compliance.

- Seizing Opportunities through Innovation:

To meet Gen Z’s demands, asset managers must also enhance communication in engaging this younger generation. The expectation for digital-first interactions is higher than ever. This generation prefers platforms that provide both innovation and insight with a few clicks.

The Role of Technology in Modern Stewardship:

Technology plays a crucial role in aligning stewardship practices with Gen Z’s expectations. Modern digital solutions facilitate streamlined, efficient management of ESG engagements. They enable asset managers to conduct in-depth analysis and foster continuous dialogue, enhancing transparency and accountability. Tools like Maanch, offering AI-driven dashboards and real-time reporting systems are indispensable in this new era of stewardship.

Future Directions: Preparing for the ‘Great Transfer’

As the ‘great transfer’ of wealth begins over the next two decades, the influence of Gen Z will only grow. Asset managers must prepare for this by developing more responsive, flexible stewardship models that can adapt to rapidly changing preferences. The future of investment is one where risk management, return on investment, and real-world impact are inseparably intertwined. The shift towards ESG-integrated investment strategies presents both challenges and opportunities. One significant challenge is the need for a deeper understanding of what constitutes effective ESG investments. Moreover, the financial sector must adapt to increasingly stringent regulations regarding sustainability reporting and ESG disclosures. However, these challenges also open doors for innovation in financial products and services that can cater to this new demand.

Conclusion: The Future of Investing with Gen Z

The demands of Gen Z are setting new standards in the investment world. As stewards of capital, asset managers must rise to this challenge by embracing change and innovating continuously. By adapting stewardship for Gen Z, the financial sector can thrive in a complex global market. The integration of risk, return, and real-world impact is a fundamental shift towards sustainable and responsible investing. We recently hosted a Webinar on this topic – if you would like to access slides please reach out to: sarah@maanch.com.