In recent years, Environmental, Social, and Governance (ESG) factors have become a focal point in the financial industry. Driven by growing investor demand and societal expectations, regulatory bodies worldwide are introducing more stringent ESG regulations. For asset managers, staying compliant with these evolving regulations is both a challenge and an opportunity. Here’s a look at some of the evolving ESG regulations, including the updated PRI regulation database and the The European Securities and Markets Authority guidelines.

The Principles for Responsible Investment (PRI) Regulations Database:

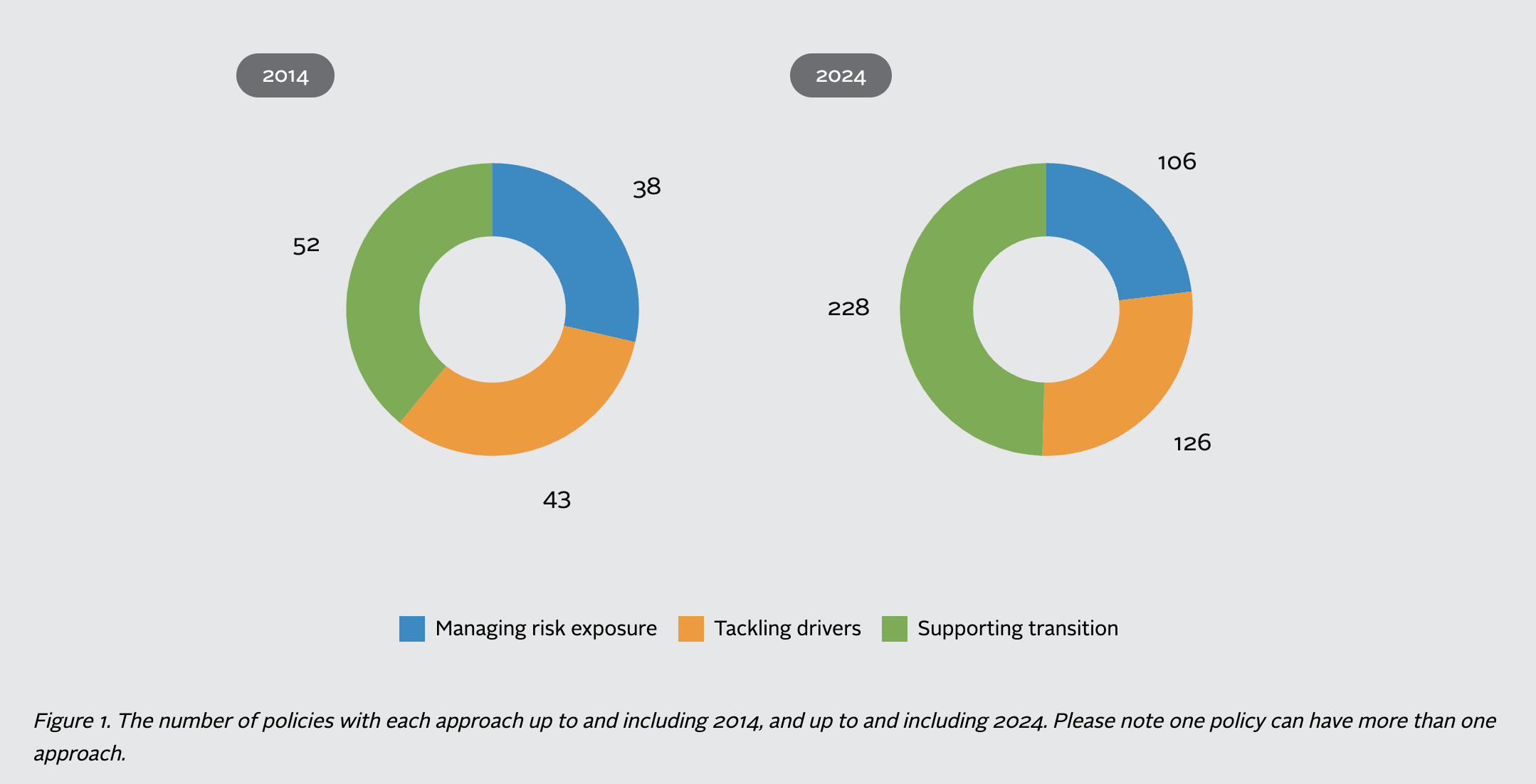

The Principles for Responsible Investment (PRI) regulation database tracks financial, corporate, and economic policies that support or require responsible investment practices. The latest update covers the top 20 countries by PRI signatories, G20 members, and the EU. It shows significant growth in sustainability-related policies since 2014. The database highlights an increase in policies referencing the Paris Agreement and those supporting an economy-wide transition towards sustainability.

Unlike previous versions of the regulation database which counted the number of regulations worldwide, this update focuses on the comprehensiveness of policies in 29 key jurisdictions. We can see that more policies, and of greater variety, are being introduced to support the economic transition. The database tells us that since 2014, across the jurisdictions assessed, the variety of policies has increased by a third.

Regulations Database Findings:

In previous versions, PRI’s regulation database clearly demonstrated that the number of responsible investment policies and regulations had grown significantly worldwide and that out of 316 policies assessed between 2019-2022, 79% included direct or indirect sustainability outcome requirements.

In the 2024 update, PRI has moved their focus from monitoring this exponential growth to understanding the comprehensiveness of policy reform across a set of key markets.

The database tells us that since 2014, across the jurisdictions assessed, the variety of policies has increased by a third (from 15 different types of policy to 20), with the introduction of taxonomies, investor due diligence requirements etc. In the same period, the number of policies that reference the Paris Agreement has increased from 33 to surpass 200 out of 379 entries in our database.

There is also an increased focus on regulations which support governments to drive the economy-wide transition towards a sustainable future . This policy approach recognizes that the financial sector alone cannot tackle system-level sustainability-related risks, and a whole-of-government approach is needed.

The European Securities and Markets Authority Guidelines:

Part of the evolving ESG regulation landscape has been the recent update by the European Securities and Markets Authority (ESMA). ESMA has issued new guidelines to harmonise the use of ESG and sustainability-related terms in fund names. Funds using these terms must meet a minimum threshold of 80% of investments in ESG objectives. The guidelines also set exclusion criteria for terms like “Environmental,” “Impact,” “Transition,” and “Governance.” The guidelines will be effective three months after their publication in all EU languages, with a six-month transition for existing funds.

The ESMA guidelines establish harmonised criteria for using ESG and sustainability-related terms in fund names to prevent greenwashing. Key points include:

- Minimum Investment Threshold: Funds must invest at least 80% of their assets in line with ESG objectives to use ESG terms in their names.

- Additional Sustainability Focus: Funds using terms like “sustainable” must ensure 50% of their investments meet sustainable investment criteria.

- Exclusion Criteria: Specific criteria exclude certain investments from being labelled as ESG.

- Implementation Timeline: Effective three months post-publication, with a six-month transition for existing funds.

Implications for Investors:

The ESMA guidelines on ESG fund naming, aimed at preventing greenwashing, are a great step forward towards reducing risks around greenwashing. However, this new regulation could disrupt the market for green bond investors, leading to fund reclassifications and compliance challenges. Funds may need to reassess their portfolios, potentially causing investor confusion and market volatility. Despite the intention to enhance transparency and integrity, the guidelines may introduce complexities, especially for funds focusing on green bonds.

Conclusion:

As we have seen, there has been a great increase in the number and scope of ESG regulations today. This is a positive step forward towards increasing transparency, promoting sustainable standards, reducing greenwashing and encouraging investors to prioritise sustainability policies. Although there might be a phase of adaptation for Investors to come to terms and grapple with these new guidelines, there is an increasing need for significant regulatory compliance. Investors will now be held accountable and face more scrutiny on their Sustainability Funds.It is therefore imperative to adopt a proactive stance, utilising available resources to stay informed and compliant.

Visit our website to learn more about ESG Regulations, staying compliant and generating reports.