From Good to Exceptional: How Maanch’s Engagement Tracker Delivers Deeper Value

In a landscape crowded with engagement tracking tools, Maanch stands apart by transforming how you approach stewardship. Our platform doesn’t just log interactions—it powers a new era of impactful investing through:

- Strategic Alignment: Ensuring your stewardship activities directly support your broader sustainability and investment goals.

- Data-Driven Insights: Moving beyond surface-level metrics to uncover deeper trends and identify areas for improvement.

- Proactive Engagement: Anticipating challenges and opportunities to engage with companies effectively.

- Measurable Impact: Demonstrating the tangible value of your stewardship efforts to stakeholders.

The investment industry stands at a critical juncture where enhancing stewardship resources is not just beneficial but also essential for long-term sustainability and risk management. The insights from the Stewardship Resources Assessment Framework, the Global Stewardship Resourcing Survey, and the comprehensive Stewardship Resourcing Report shed light on the current practices and underscore the urgent need for a structured, data-driven approach to stewardship resourcing.

Additionally, investment professionals face numerous daily challenges, from managing schedules and tracking engagements to staying on top of important dates and tasks. To address these challenges, Maanch Engagement Tracker is dedicated to providing innovative solutions, making it easier for users to achieve greater daily stewardship efficiency. We tackle inefficiency with a three-pronged approach: structured measurement, enhanced transparency, and cultivating collaborations. By integrating powerful tools and functionalities, Maanch ET streamlines workflows, boosts productivity and ensures every detail is captured. In this blog, we’ll delve deeper into specific challenges faced by investment professionals and showcase how Maanch ET conquers them.

Engagement Tracker – Newly Released:

- Feature: Morningstar Sustainalytics Integration

Maanch has partnered with Sustainalytics to track direct engagements with portfolio companies and Sustainalytics Engagements all in one place. This seamless integration allows clients to access ESG insights alongside their existing data, enabling enhanced stewardship reporting and meaningful engagement with investee companies. Exportable reports in PDF and XLS formats simplify inclusion in annual ESG reports, with Sustainalytics data clearly distinguished from direct engagements.

- Feature: Contact Book

Up to date contact information and accurate logging of points of contact are extremely important to keep track of engagement progress. Your Microsoft Outlook contacts can now be imported into the dashboard to tag them to interactions and scheduling meetings. In addition, you can also map contacts to entities in the dashboard.

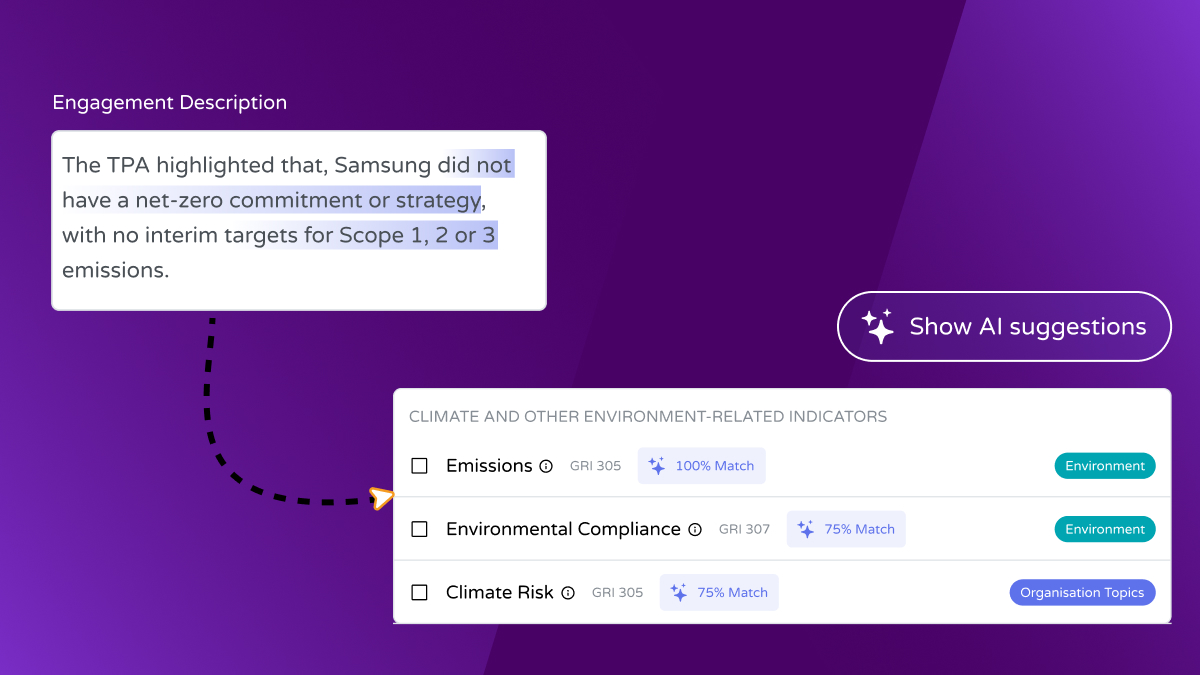

- Feature: Choose issue topics using AI

Maintaining consistency throughout your ESG Reporting can be tricky if teams aren’t aligned on topic selection. Our latest AI feature is designed to streamline your ESG reporting process. This innovative tool uses artificial intelligence to automatically suggest relevant GRI, Organisation, and SFDR topics based on your issue descriptions.

Structured Measurement:

Adopting a structured measurement approach is vital. It enables organisations to quantify stewardship efforts and align them with overarching sustainability and risk management objectives. In fact, structured measurement provides a clear framework for assessing the impact of stewardship activities, ensuring that efforts are targeted and effective. Thus without a structured approach, organisations may find it challenging to demonstrate the value of their stewardship activities. Which could potentially undermine their sustainability goals and risk management strategies.

- Feature: Customised and Detailed Reporting for Deeper Insights

Reporting has always been a challenge. Asset managers need the flexibility to create reports that meet their specific needs and reflect the nuances of their engagements. Consequently, we’ve introduced a range of new reporting filters based on client feedback and recent trends. Users can now tailor their reports to focus on engagements related to particular topics or generate reports for specific teams. These enhancements offer greater flexibility and customisation, enabling users to derive more precise insights from their data.

- Feature: Keep Track of AGM Dates

Timely engagement with companies before AGMs is crucial for informed decision-making and effective voting strategies. On Engagement Tracker, we display upcoming Annual General Meeting (AGM) dates directly on the dashboard. Consequently, users can plan their engagements well in advance of the voting season. This helps ensure they can inform companies of their decisions or clarify any questions in a timely manner.

Enhancing Transparency:

Improved reporting and transparency around stewardship activities allow for better monitoring and comparison. Therefore fostering a culture of accountability and continuous improvement. Transparency ensures that all stakeholders, including investors, regulators, and the public, have a clear understanding of stewardship practices and outcomes. Without enhanced transparency, there is a risk of inconsistent reporting and a lack of accountability. Furthermore this can then lead to stakeholder distrust and potential regulatory issues.

- Feature: Maintain Companies Watchlist

Keeping a close eye on the performance of companies that require the most attention is crucial. Creating a watchlist for companies on Maanch Engagement Tracker allows users to monitor high-priority entities effectively. By adding companies to a watchlist, investment professionals can easily track their performance and receive updates, therefore ensuring they can act swiftly when necessary. Without a dedicated watchlist, keeping track of numerous high-priority companies can be cumbersome and prone to oversight.

- Feature: Close the Engagement Loop with Outcome Logging

Effective stewardship requires not just initiating engagements but also evaluating their outcomes to assess effectiveness and impact. In fact, our new functionality allows users to seamlessly add and report issue outcomes when closing an issue. By analysing the outcomes, asset managers can determine whether the engagement objectives were met, evaluate company performance, and refine future strategies. Without automated logging and analysis of issue outcomes, asset managers may struggle to assess the impact of their engagements.

- Feature: Stay Informed with Relevant News

Staying updated with the latest ESG news about portfolio companies is essential for making informed investment decisions and effective engagements. For this reason, we added the News API feature, which provides seamless access to recent ESG news of portfolio companies. By integrating this feature, investment professionals can quickly access relevant news, helping them stay ahead of potential issues and opportunities.

Cultivating Collaborations through our Engagement Tracker:

Encouraging collaboration within the industry can enhance the effectiveness of stewardship activities, pooling resources for a greater collective impact. Indeed, collaborative efforts can lead to shared best practices, joint initiatives, and more significant overall progress in sustainability and risk management. Without collaboration, organisations may work in silos, thus missing out on opportunities for synergy and collective action that can drive more substantial change.

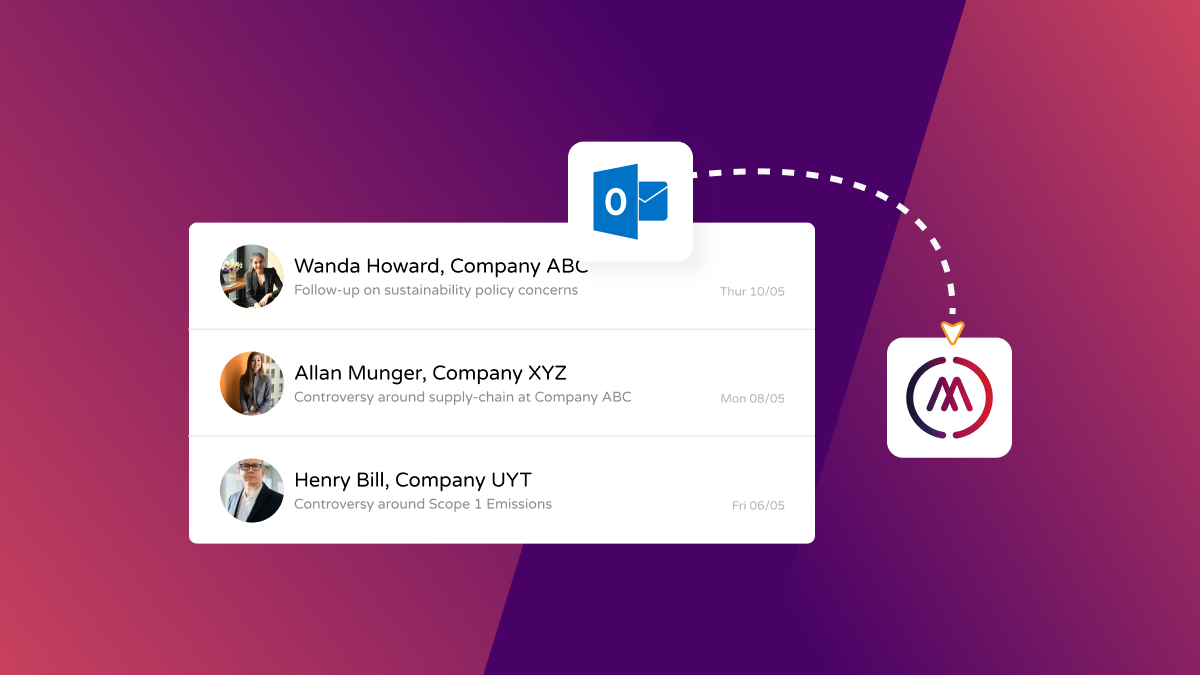

- Feature: Track Email Communications Efficiently with Outlook Integration

Investment professionals often need to log numerous email communications, which can be time-consuming and prone to errors when done manually. Our integration with Outlook allows users to log emails directly into the Maanch Engagement Tracker without manual copying and pasting. This automation saves valuable time and enhances productivity by streamlining the workflow. By ensuring that all communications are accurately recorded, investment professionals can maintain a comprehensive record of interaction, which is crucial for effective engagement and accountability.

- Feature: Stay on Top of Engagements with Reminders

Missing key engagements or follow-ups can hinder effective stewardship and damage relationships with stakeholders. This is why we developed the new Reminders feature, allowing users to create custom reminders for important engagements. This ensures that no critical meeting or task is overlooked, thus enhancing organisation and follow-through. By setting timely reminders, asset managers can proactively manage their engagements, ensuring they address all necessary actions promptly.

Conclusion:

In the fast-paced investment industry, achieving greater daily stewardship efficiency is paramount. This is essential for generating long-term value and meeting the evolving needs of stakeholders. Maanch Engagement Tracker’s latest features address the key challenges faced by investment teams, from managing schedules and tracking engagements to staying on top of important dates and tasks. By providing tools that streamline workflows, enhance productivity, and ensure no detail is overlooked, Maanch’s Engagement Tracker empowers users to:

- Optimise stewardship workflows.

- Enhance collaboration and transparency.

- Drive and communicate measurable ESG impact with confidence.

- Meet regulatory requirements with ease.

- Strengthen relationships with companies.

To explore the power of Maanch ET contact our team here: info@maanch.com