Prior to the pandemic, a reason behind the lag of the business community in embracing environmental and social sustainability was, in part, due to the differing world views of senior managers. However, matters of ESG no longer limit themselves to being moral imperatives. They are now fiduciary responsibilities that all senior management have to undertake in order to ensure that their companies are prepared for disruptive changes in the future.

These strategic challenges involve:

(i) the medium and long term viability of the firm,

(ii) the financial performance of the business & shareholder return,

(iii) size and scope of the business in terms of geographies and market segments.

Within these key stakes lie the following risks which prove sufficient ground enough to act:

(i) the legal and social license to act, both from the public and the regulators,

(ii) a long term approach to risk management,

(iii) consumer loyalty for the brand and risks of ethics washing,

(iv) tech-facilitated interventions that have made things more transparent, and

(v) effects of globalizations and country specific due diligence.

Therefore, assessment of environmental sensibility of the company would be the first step in a transition to the ESG journey. In plain terms, environmental sensibility of a company is the degree to which its internal and external stakeholders are aware and involved in activities that directly or indirectly affect the environment.

Depending on the context the few factors that affect this sensibility are:

(i) the nature of the business and its regulatory burden,

(ii) the commitment level of shareholders to environmental issues,

(iii) outside pressure from interests groups like customers, regulators and consumers,

(iv) internal interests primarily around key segments of the firm’s managers and employers.

Below is a snapshot of the strategic options available to move forward as per the company’s environmental sensibility.

| STRATEGIC OPTIONS | POTENTIAL RISKS |

| Break the Law | Forgo social and legal license + additional effort in understanding the regulations for circumvention |

| Take the Low Road | Late adaptation to inevitable ESG trends might cost long term to the company + fiduciary responsibilities |

| Wait and See | Requires accurate prediction of change and quick change to new currents, usually not feasible |

| Show and Tell | Risk of greenwashing and double-standards in the face if crisis, risking the company’s license to operate |

| Pay for Principle | No risk |

| Think Ahead | No risk |

Pay for Principal in a nutshell means: Board level decision to forgo short term financial metrics for ethical gains of shareholders + Overhaul of operations for future proofing the company growth and Thinking ahead, modelling strategies on business logic + factoring ESG related factors of key stakeholders in the value chain helps build long term competitive advantage, hedge against future legislation and tackle emerging strategic challenges. For a few, they come out as thought leaders in this space!

Driving a company wide transition:

Bring the Board

Bringing the board together on the transformation and driving a company wide cultural change are keys to making ESG-related shifts work alongside the general market research conducted for the cause. A thorough scanning of past, present and future trends, especially collaborative, industry wide and cross sectoral efforts done to consolidate frameworks would be sensible that reinventing the wheel as a single player. For instance, last year under the IMP, 5 leading organizations, CDP, the Climate Disclosure Standards Board (CDSB), the Global Reporting Initiative (GRI), the International Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB), have collaborated to curate an unified framework that would dictate effective disclosures under the Task Force on Climate-related Financial Disclosures (TCFD).

Focus on Purpose but think beyond

For businesses to signal differentiation and spearhead an industry-wide change, focusing on purpose alone isn’t enough. Pre-competition actions need to be taken to leverage the full benefit of going first to market with a sustainable innovation can provide a “first mover advantage” and cement your reputation as an innovator. To hedge risks, companies can ensure their competitors make the journey with them through these three simple steps:

1. Demonstrating the business case for generating shared value – which starts moving the wheel.

2. Diffusing this change to competitors, often through cooperation and self-regulation.

3. Shifting consumer behavior, investor behavior, or regulations to lock the change in place.

Incorporate the ‘Stakeholders’ with the Shareholders

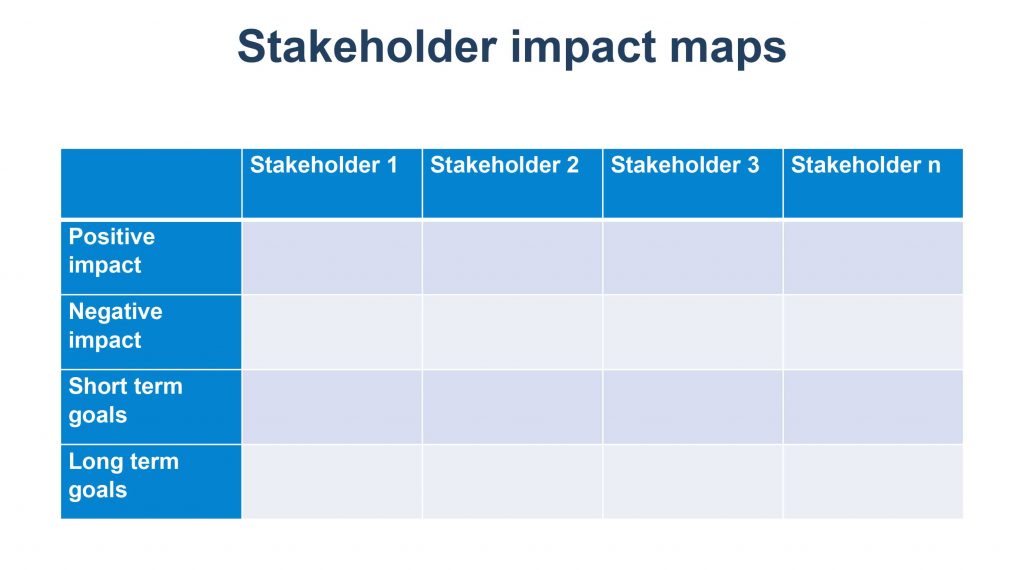

The concept of shareholders when substituted to shareholders can only be effective when the business strategy has a framework to assess the positive and negative impacts and externalities regarding each in their value chain.

Adopt a scenario prediction and management approach

In the current climate of uncertainty and low resources due to the pandemic, companies have to be judicious and extremely efficient with their resources. Scenario analysis is a method of thinking about the future by systematically considering the uncertainties a firm faces, and assigning probabilities to each of the ‘scenarios’ these uncertainties define. Gathering a group of managers, listing out general and critical uncertainties, assigning probabilities and then ascertaining possibilities might be a quick way to start things. What emerges as the viable ‘official future’ might be different and removed from the past and from expectations.

Once companies have listed down the uncertainties, the risks and opportunities related returns associated with each scenario, a comprehensive plan of values created, concerns anticipated and organizational level metrics can be mapped out.

Take account of the natural capital as a limited, finite resource and an externality

Finally, with regard to scenario management concerning transitions into sustainable business strategy, it’s crucial to draw up a S curve. This would reflect the full scope and risks of the company transition within the industry life cycle, from experimentation to maturity. A faulty assessment to change gears, if not aligned with internal and external factors can cost the company more; a strategy that speaks to the context works best.

The drive for innovation often occurs at points of ‘disruption’, nodes that often larger structured companies can’t cope with and unable to ‘jump’ in the S curves. The need to respond to the problems that we face mean that an increasing number of industries may be at risk of disruption. As opposed to previous assumptions, natural capital is not free anymore and likely to be ‘expensive’ within the regulatory framework made aware by the finitude and depletion of these resources. This knowledge can spell dead ends for some, but for others this will open up opportunities for firms willing to experiment with new technologies and new business models.

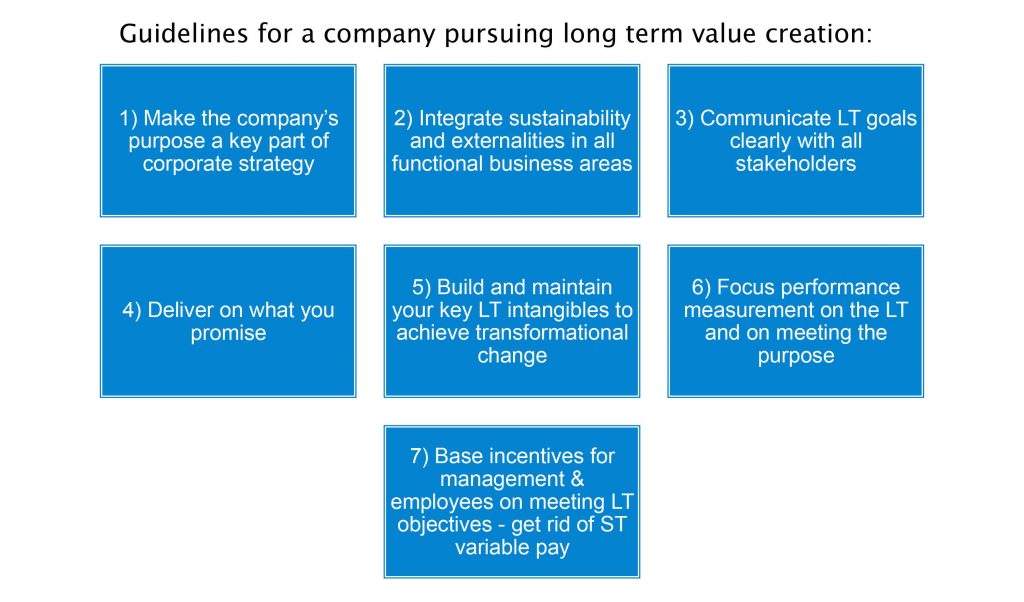

To recap, here are 8 major steps that companies can take to build long term value:

Read more about ESG on updates.maanch.com/