In the world of investment, stewardship embodies the diligent oversight and risk management of assets. Traditionally, many investors adopted a passive stance, focusing mainly on financial returns without active engagement in company affairs. However, a significant shift towards active stewardship is underway, prompted by a growing recognition of its potential to drive substantial real-world impact. Will Martindale, in his insightful book “Responsible Investment – An Insider’s Account of What’s Working, What’s Not, and Where Next,” eloquently defines responsible investment as a strategy that not only seeks to optimise risk-adjusted returns but also intentionally maximises positive and minimises negative impacts on society, the economy, and the environment through active investment decision-making, stewardship, and policy engagement. This transition from passive to active approaches marks a crucial evolution in the investment sector. It underlines a commitment to not just financial gains but to fostering transparency, accountability, and sustainable benefits across the board.

The Evolution from Passive to Active Stewardship:

Active stewardship seeks to engage with companies on corporate governance and environmental, social, and governance (ESG) practices. Passive stewardship typically involves basic monitoring of investments and voting in annual general meetings without deeper engagement.

Key differences between passive and active stewardship include:

- Engagement Level: Passive involves minimal interaction; active involves direct dialogues with senior company stakeholders.

- Influence on Corporate Practices: Active stewardship aims to shape corporate strategies, unlike its passive counterpart.

- Focus on ESG: Active stewardship places a strong emphasis on ESG factors, pushing for transparency and sustainability.

The shift towards active stewardship is fueled by several catalysts:

- Increased Awareness of ESG Issues: Investors recognise the long-term value and risk mitigation offered by sustainable practices.

- Regulatory Changes: New regulations require more transparent and responsible investment practices, encouraging active engagement.

- Investor Demand: There is a growing demand from investors for responsible investment options that offer both financial returns and positive real-world impact.

Understanding Escalation Strategies in Stewardship:

Escalation strategies in active stewardship form a crucial approach for investors aiming to influence corporate behaviour positively. These tactics move beyond basic engagement, offering structured methods to address and resolve issues with portfolio companies.

Types of Escalation Strategies:

- Direct Dialogue: Investors directly engage with company management to discuss concerns and propose improvements.

- Shareholder Proposals: Submission of proposals for shareholders’ vote, aiming to change company policies or practices.

- Voting Against Board Members: Utilising votes to express disapproval of the current board’s actions or decisions, particularly concerning governance or sustainability issues.

- Public Campaigns: Raising issue visibility through media engagement or public disclosures to pressure companies into action.

- Legal Action: Supporting or initiating legal proceedings against companies or their directors for failing to fulfil their duties regarding sustainability or governance.

“We participate in collective engagements that cover a range of ESG issues; from an investor perspective these give us greater leverage at a company, while companies benefit from a unified voice from investors on these important topics.”

– Gayle Muers, ESG Analyst – Engagement Lead, HSBC Global Asset Management, Investment Manager, UK

Benefits of Escalation:

- Improves Corporate Engagement: These strategies foster a more open and constructive dialogue between investors and companies.

- Enhances Accountability and Transparency: By publicly addressing issues, escalation tactics nudge companies towards transition to resilient business models.

- Drives Substantial Changes: Through targeted actions, escalation can lead to significant improvements in company policies and practices.

Implementing Effective Escalation Strategies:

Identifying Opportunities for Escalation:

Implementing escalation strategies begins with identifying when such actions are necessary. Here are tips to recognize these opportunities:

- Maintain clear communication, setting explicit expectations and timelines for change.

- Establish concrete, achievable goals for each engagement, ensuring both parties understand the desired outcomes.

- Document all interactions and responses to maintain a record of engagement efforts and outcomes.

- Foster a collaborative rather than confrontational relationship to encourage openness and constructive dialogues.

Leveraging Technology:

Technology plays a pivotal role in streamlining escalation efforts. For instance:

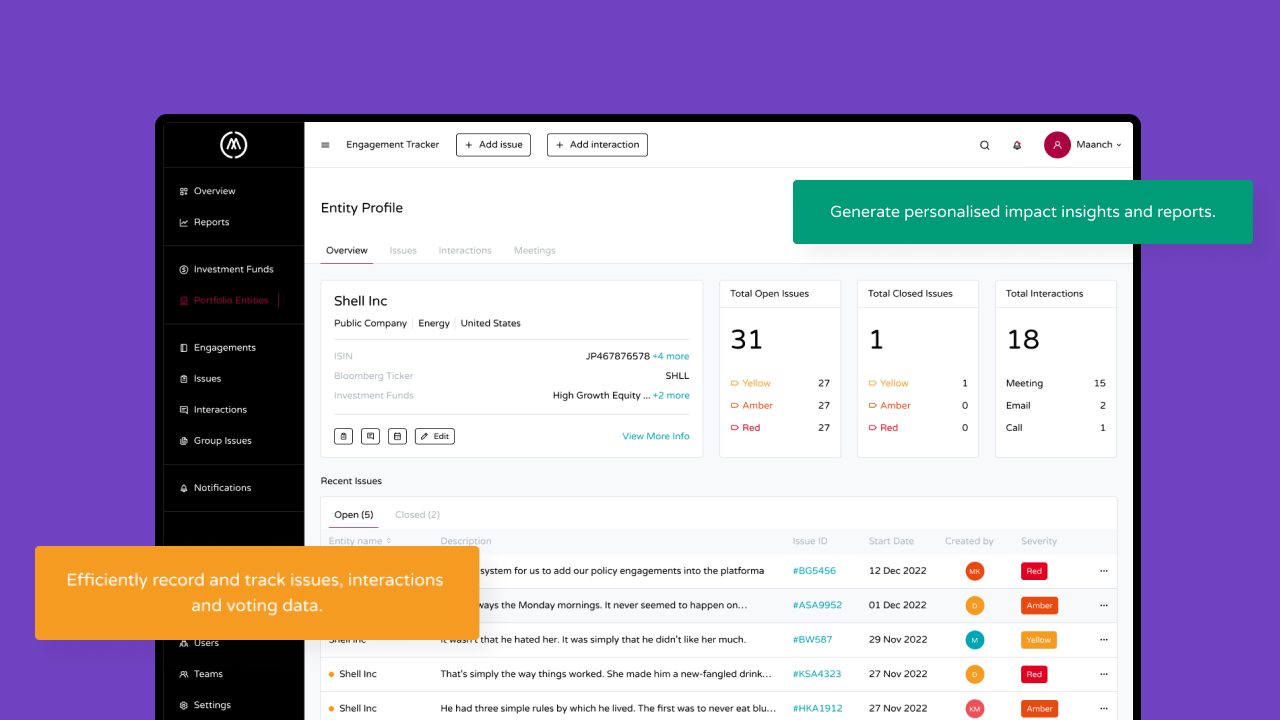

- Tools like the Maanch Engagement Tracker can help investors monitor ESG performance, engagement outcomes, and track progress over time.

- Utilise data analytics to identify trends and issues that may warrant escalation.

- Organise and manage shareholder proposals more efficiently.

Overcoming Challenges in Escalation:

Transitioning from passive to active stewardship presents challenges but also pathways to meaningful impact. A common hurdle is resistance from companies, often hesitant to alter established practices. Investors might also face difficulties in assessing the right moment for escalation or in harnessing sufficient support for their initiatives.

To navigate these obstacles, building a solid foundation of research and data proves invaluable, empowering investors to present compelling arguments. Establishing alliances with like-minded stakeholders can amplify the call for change, creating a unified front that’s harder for companies to ignore. Technology, such as the Maanch Engagement Tracker, offers critical support, streamlining data analysis and facilitating effective communication. By embracing these strategies, investors overcome barriers, paving the way for more transparent, accountable, and sustainable corporate practices.

For more keen insights A PRACTICAL GUIDE TO ACTIVE OWNERSHIP IN LISTED EQUITY by the UNPRI is a good resource.

“If you only engage after a crisis it had better be to offer a constructive way through. It’s far better to have developed a trusted relationship and helped them proactively address the issue, ahead of it becoming a problem.”

– Alison Ewings, Engagement Program Lead, Regnan

In summary:

The future of stewardship stands at a pivotal juncture, where the move towards active engagement sets a new standard for investment practices. The value of active stewardship cannot be overstated, as it propels companies towards sustainable, transparent, and accountable practices, ultimately leading to a more resilient and prosperous global economy.

Key Takeaways:

- Active Stewardship Drives Change: With clear strategies and goals, active stewardship leads to significant improvements in corporate behaviour.

- Technology is a Catalyst: It boosts the capacity to pinpoint escalation opportunities and track the effectiveness of engagement initiatives.

- Collaboration Amplifies Impact: Working together enhances the push for greater corporate transparency and accountability.

- Structured Approach to Escalation: Utilising technological tools and adhering to best engagement practices enables investors to foster positive developments.

Active stewardship, despite its challenges such as cost and resourcing, finds a powerful ally in technology. Asset managers can leverage innovations to efficiently drive outcomes, sidestepping traditional hurdles and distinguishing their strategies in the market. This approach not only bolsters engagement effectiveness but also ensures investments contribute to global betterment while yielding returns. By embracing technology, collaborating strategically, and continuously engaging, asset managers become pivotal in fostering sustainable change.